maryland ev tax rebate

The Excise Tax Credit for Plug-In Electric Vehicles is administered by the Maryland Motor Vehicle Administration MVA. In addition the Electric Vehicle Recharging Equipment Rebate Program will be extended for two more years and.

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

The Maryland EV Tax Credit is a separate program from the EVSE rebate.

. 40 up to 700 Commercial. 40 up to 700. MVAElectricRefundsmdotmarylandgov Applicants Name FIrst Middle and Last Date of Birth Co-Applicants Name First Middle and Last DateofBirth Applicants SoundexMaryland Driver License Number Co-ApplicantsSoundexMarylandDriverLicenseNumber FEIN.

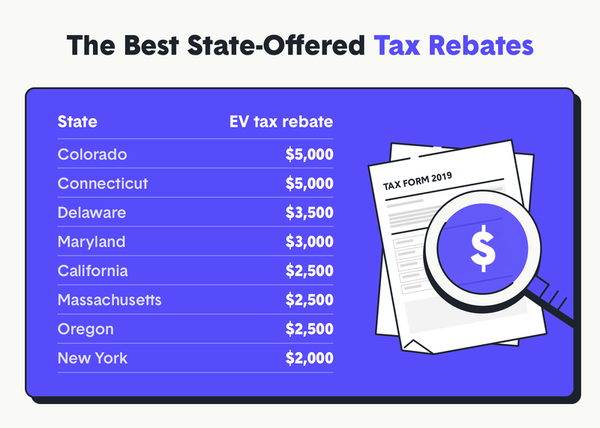

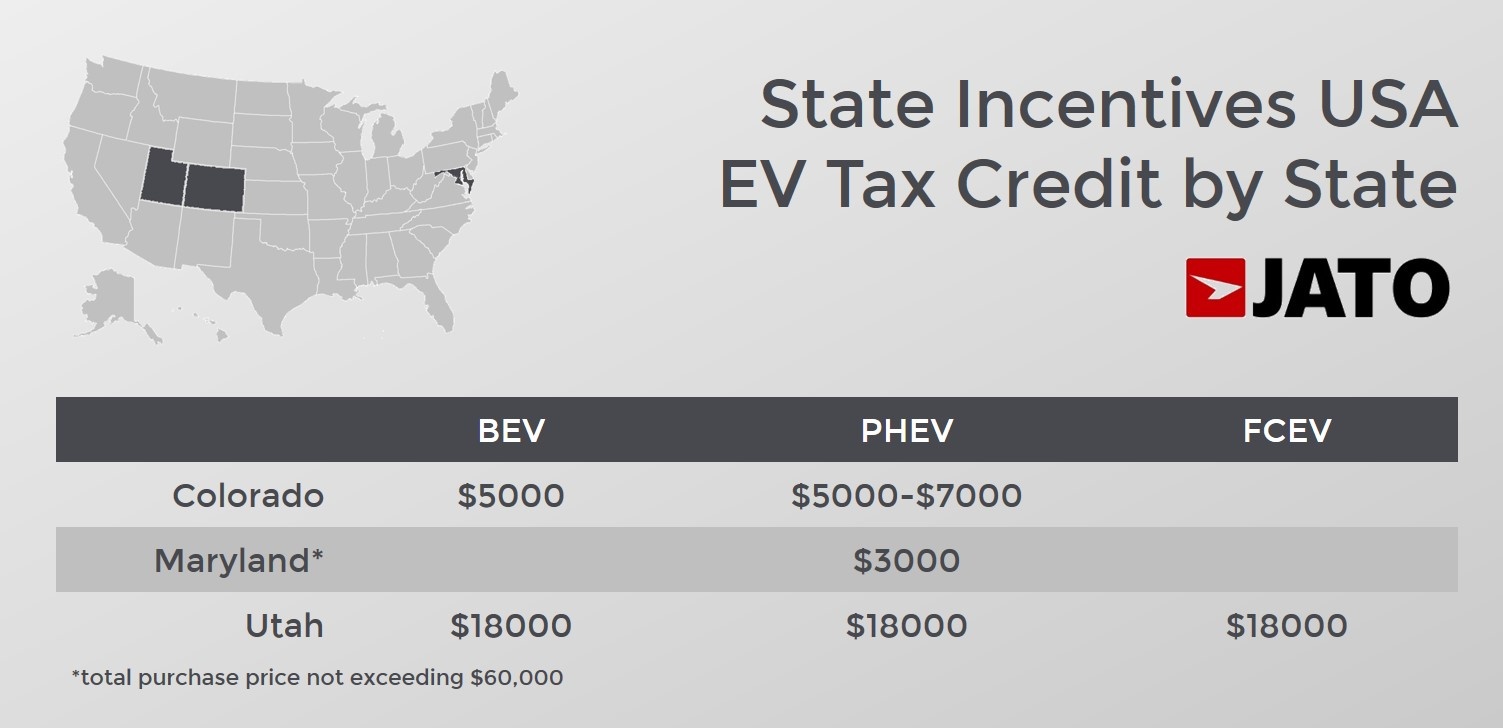

31 2031 New commercial EV credit Equal to 30 of the cost of such vehicle. The total amount of funding currently available for this rebate program in state fiscal year FY 2022 7121- 63022 is up to 1800000. As of July 1 2017 allows purchasers of qualified vehicles to apply for a tax credit of up to 3000 calculated as 100 per kWh of battery.

Marylands state electric vehicle tax credit program has proven so popular that rebate funding was depleted for the entire fiscal year before it even began on July 1 2019. B1 EVSE Equipment Cost B2 EVSE Installation Cost B3 Total EVSE Cost B1B2 B4 Multiply B3 by 040 B5 Rebate Amount Lesser of 700 or B4 I solemnly affirm under penalties of law including those set forth in Maryland Code Section 9-20B-11 of the State. You may be eligible for a one-time excise tax credit up to 300000 when you purchase a qualifying plug-in electric or fuel cell electric vehicle.

Maryland offers a. For model year 2021 the credit for some vehicles are as follows. Applicants are encouraged to thoroughly review the FY22 EVSE Rebate Program guidelines below.

And 5000 for retail service stations. Excise Tax Refund Unit 6601 Ritchie Highway NE Room 202 Glen Burnie MD 21062 Email. Marylands incentive program Electric Vehicle Supply Equipment EVSE Rebate Program 20 grants rebates to individuals for home use businesses for employees and customers and retail service stations.

As an approved vendor with multiple utilities. The Maryland legislature also has a bill to revive funding for the states electric vehicle state excise tax incentive worth up to 3000 for electric vehicles or plug-in hybrids. The Clean Cars Act of 2017 signed into law by Governor Larry Hogan authorized an excise tax credit on plug-in electric cars for three years from July 1 2017 to June 30 2020.

18 million per FY for rebates for Electric Vehicle Service Equipment EVSE. Whitmer wants to provide a combined 2500 EV rebate for families 2000 for the car and 500 for in-home charging equipment that would build on the 7500 federal electric vehicle credit. Maryland residents who purchase an electric vehicle are still.

In Maryland several energy companies offer a 300 rebate for individuals who install a qualifying level 2 charger for their electric vehicle EV. Maryland residents who purchase an electric vehicle are still. Federal Income Tax Credit A federal tax credit is available to buyers of new plug-in electric vehicles based on battery capacity and ranges.

Funds for the Maryland excise tax credit usually run out early each fiscal year. Maryland offers a rebate of 40 of the cost of Electric Vehicle Charging Equipment and Installation. 1500 tax credit for each plug-in hybrid electric vehicle purchased.

However its worth noting that certain restrictions apply and after a manufacturer has sold more than 200000 units of a particular vehicle the credit will drop to half and then expire. The Clean Cars Act of 2021 as introduced had several goals. Upon purchasing a new EV or PHEV the federal tax credit can be applied to a buyers tax liability for the year and this amount can be up to 7500.

Effective July 1 2017 through June 30 2020 an individual may be entitled to receive an excise tax credit on a qualifying plug-in electric or fuel cell electric vehicle regardless of whether they own or lease the vehicle. The federal EV tax credit is based on the capacity of the vehicles battery back. Local Virginia and Maryland Electric Vehicle Tax Credits and Rebates.

Funding for the Maryland EV Tax Credit has been exhausted and no further funding is currently authorized. Rebates are calculated on a per charger basis by multiplying40 by the purchase and installation price of the EVSE and are capped at thefollowing amounts. Must not exceed 50 of the sale price of the EV Must be at least 2 years old and MSRP must not be above 25k.

And at 29 the transportation sector is the biggest contributor to national greenhouse gas emissions. Rebates are calculated on a per charger basis by multiplying 40 by the purchase and installation price of the EVSE and are capped at the following amounts. Tax-exempt entities have the option of electing to receive direct payments.

This is a refund of a tax you already paid and no more. 40 up to 4000 An entity applying for commercial rebates cannot receive more than 20 of the program budget in a fiscal year. You do not need to.

Maryland citizens and businesses that purchase or lease these vehicles. The MD EV excise tax credit is not income. The rebate is up to 700 for individuals.

The Maryland Electric Vehicle Tax Credit. A whopping 90 of the energy consumed from transportation in the US comes from petroleum. In other words it is not a refundable tax credit which would be income because it would be over and above the tax you paid.

Maryland Freedom Fleet Voucher Program. Electric car buyers can receive a federal tax credit worth 2500 to 7500. The Virginia General Assembly approved HB 1979 which provides a 2500 rebate for the purchase of a new or used electric vehicle.

Theres good news on the local front on electric vehicle tax incentives and rebates in Virginia. First was to fund the backlog of applications from EV purchasers who are on the waitlist from the prior EV tax credit program. Non-competitive first-come first-served Anticipated Program Budget.

Federal EVSE credit of up to 30 or 1000 for charging station equipment. If the purchaser of an EV has an income that doesnt exceed 300. The credit ranges from 2500 to 7500.

Applicants are then put on a wait list until the next round of funding is released. You may be eligible for a one-time excise tax credit up to 300000 when you purchase a qualifying plug-in electric or fuel cell electric vehicle. Tax credits depend on the size of the vehicle and the capacity of its battery.

Battery capacity must be at least 50 kilowatt-hours. Eligible purchase price on plug-in fuel cell vehicles raised from 63000 to 73000. Electric Vehicle Supply Equipment Rebate Program Through the program residents governments and businesses can acquire a state rebate for purchasing and installing an electric vehicle charging station known as Electric Vehicle Supply Equipment EVSE.

Best State To Buy Electric Car Cheap Sale 60 Off Www Vetyvet Com

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

Elon Musk Reveals A Key Detail About The Model 3 S Battery Tesla Model Tesla Car Tesla Motors

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Electric Vehicle Charging Points Electric Car Charging Electricity Electric Vehicle Charging

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Incentives Maryland Electric Vehicle Tax Credits And Rebates

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

What Are Maryland S Ev Tax Credit Incentives Easterns Automotive

What Are Maryland S Ev Tax Credit Incentives Easterns Automotive

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Under New Postmaster General A Trump Donor Electric Mail Trucks Get Postponed Again Https T Co Gdumsshlso By Bradberman Bjmt Mail Truck Trucks Ford Transit

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech

Incentives Maryland Electric Vehicle Tax Credits And Rebates

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

Latest On Tesla Ev Tax Credit March 2022

Maryland Ev Percentage By County August 2021 Pluginsites

Incentives Maryland Electric Vehicle Tax Credits And Rebates